Innervation Capital Partners

Firm’s Investment Strategy

Innervation remains a theme driven investor, driving superior returns from proprietary deal sourcing, with an exclusive focus on education.

Innervation has been investing in the Education sector since 2016. During this ten year period, the Firm has acquired 57 Early Years Settings, built the UK’s leading Early Years apprenticeship training provider, acquired 7 SEND Schools and provided funding for 5 green field SEND schools, the first of which opened in 2023.

Innervation currently deploys capital in 3 themes to maximise returns:

Theme One: Invest in “upskilling” and expanding early years childcare capacity for its high impact potential

The Firm’s most recent exit from Innervation Education & Training demonstrates the benefits of taking a long term, thematic approach: this leading early years apprenticeship business was transformed over an 8 year holding period.

Early Years apprenticeship revenue increased tenfold, reflecting:

- an unwavering focus on building the market leader in Early Years;

- a relentless commitment to quality with 90% learner satisfaction & 78% quality achievement rates, which is industry leading;

- +78 customer NPS score and +93 employee NPS, which are world class; &

- 95% customer retention.

This operational excellence provided the foundation to scale the platform as lifetime customer value exceeded customer acquisition cost by 9x. These marketing metrics underpin future growth in a fast growth vertical.

Supporting Education Group (“SEG”) acquired Innervation Education & Training in December 2024. Lorna Newbould, who founded the business in 2008, will remain as MD post deal. We wish her and her team every success in the future and look forward to our continuing association through ICPEducare as it scales.

“I feel passionate about staff training and development; I’ve always found that investing in talent offers new and dynamic ways of getting the job done, none more so than with apprentices, as employers see their knowledge, skills and behaviours develop. I am looking forward to continuing our growth as part of SEG, who also share our commitment to improving society through education and learning.” – Lorna Newbould

The Firm will continue to focus on this “upskilling” theme with the planned launch of Equity in Early years, which will deliver training in less affluent areas of the UK where access to outstanding early years education is ten times less likely to be available to parents.

Theme Two: Invest in “underserved markets” for superior returns and scalability

The Firm launched its first Early Years platform, ICP Nurseries (now called Bright Stars Nurseries), in 2016. Innervation identified the “underserved” s

The ROI of investing in early years can be attractive both financially and socially. The first five years of life are the fastest period of human growth and development as 90 percent of a person’s brain development occurs by the age of five. Investing in the early years helps to break the cycle of poverty, address inequality, and boost productivity.

In the U.K. more than a quarter of four-and-five-year-olds (28 per cent) lacked the early communication and literacy skills expected by the end of reception year. The ‘expected level’ includes, for example, a child being able to express themselves clearly and read simple sentences.

ICP Educare is the Firm’s most recently launched Early Years platform: Innervation is backing the same proven leadership team it backed at ICP Education & Cresswell Nurseries.

- ICP Educare was launched in February 2024 to deliver its targeted ‘’Buy and Build’’ of high quality Early Years schools.

- ICP Educare initiated its Buy and Build strategy with the £6mm acquisition of Phoenix Park Nurseries and invested a further £21.5mm to acquire Shotley Bridge Day Nursery, Poplars Blossoms in Nottingham, Oxfordshire Nurseries, two Child First Settings in the Midlands & Woodlands in Newton Le Willows.

-

ICP Educare announced on January 16, 2026 that it has secured financial backing from Beechbrook Capital with a new £5mm preferred equity commitment alongside £30mm of senior debt provided by OakNorth Bank & £10mm of institutional equity from Innervation Capital Partners. The Beechbrook transaction reflected an enterprise value of over £60mm at a valuation multiple of 10x Maintainable Pro Forma EBITDA.

- Beechbrook – the leading SME credit provider – previously backed ICP Nurseries in 2017 before the leveraged recapitalisation with Ares and sale to Oakley Capital IV in 2021.

-

ICP Educare has three further acquisitions in exclusivity, requiring capital deployment of £14mm. On completion the group will comprise: 15 settings with approaching 1,500 registered places serving 2,500 families; £8mm EBITDA with gross leverage of less than 4x and a focus on increasing occupancy in underserved markets with low levels of penetration by formal childcare; with a mission to achieve 100% school readiness and industry leading quality metrics under the new OFSTED inspection regime with Strong Standards of Leadership and Management and world class staff NPS with 80% of staff qualified to level 3 or above.

Commenting on the transaction, Dominic Harrison MBE, Executive Chair of ICP Educare, added:

“We value the continued support of Oaknorth Bank immensely and look forward to delivering on our proven business plan of adding value to strong nurseries through investment in quality in all that we do. We are delighted to add Beechbrook Capital to our roster of investors and look forward to working with them again.”

ICP Educare’s aim remains to create the leading provider to underserved and underpenetrated markets in the £12bn fragmented Early Years market serving 1.6mm children from 9 months to rising 5 years old. The Group’s strategic ambition is to reach 20 settings and to build a group with best-in-class Leadership & Management and Achievement rates across all of its settings. All settings are inspected twice a year to ensure the Group achieves this quality transformation within 12-18 months post acquisition.

Theme 3: Invest in “SEND”, helping the most disadvantaged children in society to realise their full potential & to avoid becoming NEET as an adult

Innervation is also one of the Co-Founders, & Firm’s CIO is the largest equity investor in one of England’s leading independent Special Educational Needs & Disability providers, backing the same Chief Executive that led ICP Nurseries. The Firm’s strategy is to acquire seven to ten “bridge-heads” or Special Schools serving multiple local authorities & leverage these relationships to open two green field operations per annum in this fragmented market which addresses the higher acuity needs of around 30% of 500,000 children with Education & Health Care Plans.

Growth reflects increasing awareness of mental health issues and recognition that mainstream schools are unable or unwilling to meet the complex needs of children diagnosed with mental health challenges. Autistic spectrum disorder remains the most common type of neurodivergent behaviour.

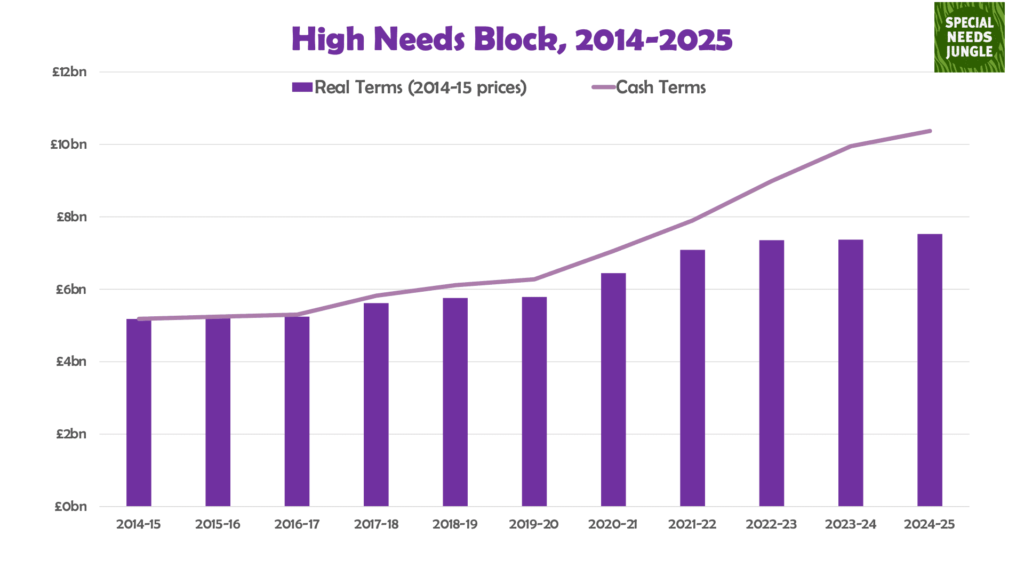

Some LAs have seen their High Needs Block increase by nearly 90% since 2019; others have had a much lower increase of around 40%. That’s mostly down to the arcane methods that the DfE uses to calculate and allocate high-needs funding.

The cumulative local authority High Needs budget deficit is estimated to be around £2.3bn and is increasing daily. The latest estimates conclude that the cumulative local authority High Needs budget deficit across England will be around £3.6bn by March 2025.

This is reinforced by the number of local authorities that are working with the DfE through its intervention and support programmes – The Safety Valve Programme (34 LAs) and the Delivering Better Value in SEND programme (55 LAs). These programmes have been introduced to assist those local authorities with the greatest deficits.

The total number of SEN schools is now approximately 2,000. The majority of students, approximately 83%, were attending schools provided by the public sector. An estimated 25,000 pupils attend 595 Independent Special Schools, typically addressing the most complex needs on the highest per capita additional funding bands.

Scalability

Innervation has the capacity to invest equity from £1 million to £20 million and has the risk appetite & patience to scale platforms from start-up to £25 million EBITDA, providing both capital and operating expertise, over a 5-10 year holding period.

![Innervation Captial Capital [ICP] - Logo](https://innervationcapital.com/wp-content/uploads/2018/08/Innervation-Captial-Capital-ICP-Logo-360x0-c-default.png)